A portion of the expense builds influence Venmo, as well.

Beforehand, PayPal had a level rate for traders and venders of 2.9 percent of an exchange’s cost, in addition to a 30-penny expense. Presently, that rate is seeing an increment relying upon the strategy for installment.

PayPal Raises Merchant Fees for Some of Its Newer Functions

Senior VP Dan Leberman has presented on PayPal Newsroom saying that the online installments framework is bringing its distributed rates up in the US.

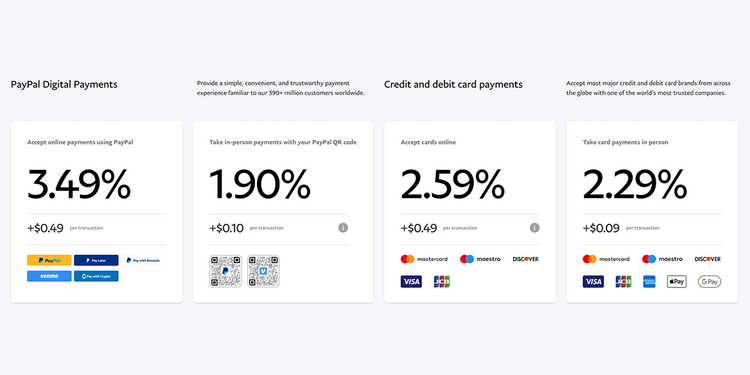

The new rates will apply to some dealer clients beginning August 2, as the element will probably take a short time to completely carry out. Here’s a breakdown of the multitude of expenses for every installment technique per exchange:

- Computerized installments (for example PayPal Checkout, Pay with Venmo, and so on) – 3.49% + $0.49, remembering Seller Protection for qualified exchanges

- In-person installments – 1.90% + $0.10 (or 2.40% + $0.05 if your sending $10 or less) for QR code exchanges, and 2.29% + $0.09 for certain charge and credit exchanges

- Online credit and charge installments – 2.59% + $0.49 without Chargeback Protection, or @.99% + $0.49 with Chargeback Protection

- Noble cause exchanges – 1.99% + 0.49 for affirmed noble cause, subject to application and pre-endorsement

In case you’re a US shipper that has custom or non-standard evaluating, PayPal says that rates stay unaltered for your administrations.

Why Is PayPal Raising Its Fees?

While the blog entry has a header that asks, “For what reason are we rolling out this improvement?”, the content underneath it appears to steer clear of the real issue rather than clarify the organization’s thinking—Leberman first discussions about the “benefits” that traders get in utilizing PayPal.

For example, clients that utilization PayPal are purportedly 60% bound to change their installments over to your favored money than the individuals who pick an elective installment strategy.

Yet, with or without that, apparently PayPal is attempting to say it needs more assets to improve the assistance:

Furthermore, we are proceeding to accomplice and put resources into our foundation to upgrade installment encounters, give more noteworthy decision to the manner in which individuals pay for labor and products, improve assurance and safety efforts to give individuals true serenity while executing carefully, and improve approval and transformation rates.

It merits nothing, notwithstanding, that the computerized installments area is seeing more rivalry nowadays. PayPal may claim Venmo (an installment application zeroed in on more close to home exchanges), however there’s a lot of other mainstream computerized alternatives to send cash.

Money App, Stripe, and surprisingly Twitter’s recently added, on-profile Tip Jar are seeing a decent measure of foothold, so maybe this is PayPal’s endeavor to compensate for misfortunes as certain people trade to different other options.

On the off chance that you need to find out about PayPal’s new changes top to bottom, you can see the notification on the Policy Updates page, the Merchant Fees page, or potentially the Pricing FAQ.