Will national bank advanced monetary forms supplant digital currencies?

Cryptographic forms of money have appreciated huge achievement and development in the course of recent years, to such an extent that whole countries are currently hoping to coordinate the hidden innovation inside their monetary frameworks.

National banks understand that they can remove colossal worth from advanced monetary forms, particularly close by the overall push for credit only exchanges.

While national bank computerized monetary forms (CBDCs) are regularly promoted as a progressive advance for fiat monetary standards, it is important that they have additionally produced huge debate of late. Shockingly, digital money fans express the absolute most intense dissatisfactions in such manner.

Is a CBDC the Same as a Cryptocurrency?

First of all. CBDC represents national bank advanced cash.

The most concerning issue cryptographic money clients have with national bank-gave computerized monetary forms is that they bear next to no likeness to digital currencies like Bitcoin. This is on the grounds that CBDCs are characteristically concentrated, which implies that a solitary authority is responsible for token issuance, exchange confirmation, and the organization’s drawn out security.

Then again, most digital currencies have been planned explicitly to work without governments and national banks, shedding their impact and money related approaches like quantitative facilitating. Truth be told, Satoshi Nakamoto—Bitcoin’s pseudonymous maker—conceded that the 2008 financial emergency impacted Bitcoin.

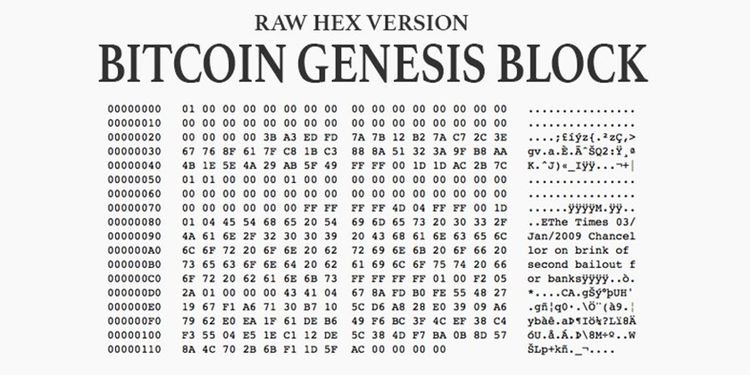

Bitcoin’s first-since forever block was mined in January of 200 and incorporated the content, “The Times 03/Jan/2009 Chancellor on edge of second bailout for banks.” This message was an immediate reference to a title text on the first page of the UK day by day paper, The Times, which thus was remarking on the precariousness brought about by banks at that point.

Rather than depending on a national bank-esque element, digital forms of money, for example, Bitcoin use agreement calculations to guarantee the honesty and security of the organization. They are additionally regularly dependent on blockchain innovation, which guarantees public straightforwardness and responsibility.

Most national bank-planned computerized monetary standards will probably not be blockchain-based and, thus, likely not influence a considerable lot of the cryptographic rules that structure the bedrock of cutting edge digital forms of money. All things considered, governments all throughout the planet are forcefully pushing for CBDC advancement.

The Bank for International Settlements (BIS), which is frequently alluded to as the “bank for national banks,” tracked down that a stunning 86 percent of the world’s national banks are effectively exploring the potential for CBDCs in 2021.

CBDCs Aren’t Decentralized: So What’s the Point?

Governments advantage the most from a likely CBDC since it would permit them to combine authority over their separate monetary standards.

Money, which has been the true mode of trade for quite a long time, is famously untraceable. This absence of recognizability has promoted the utilization of money among criminal undertakings, by and large for staying away from identification, tax evasion, charge aversion, or a mix of the abovementioned.

Despite the fact that Bitcoin and other cryptographic forms of money have been blamed for working with crime, the truth of the matter is that they are profoundly discernible—fundamentally more than cash. Any exchange including normal digital forms of money incorporates profoundly explicit information, including the beneficiary’s wallet address, timestamp, and objective.

The special case for this standard is security driven cryptographic forms of money like Monero and Zcash, which take extra measures to guarantee client and exchange protection. Notwithstanding, the selection of these tokens stays low in spite of their potential for abuse.

Indeed, conventional cryptographic forms of money empower recognizability to such a serious level that whole organizations are currently devoted to examining dubious lawbreaker or deceitful crypto exchanges. Chainalysis, for example, has counseled a few government offices, monetary organizations, and high-profile digital currency trades.

Annihilating money for a more recognizable arrangement implies that law requirement can reference a supposed criminal’s exchange history with little exertion. Joined with the assistance of crime scene investigation and information science specialists, they can likewise anticipate the probability of illegal movement considerably more precisely.

CBDCs: Promoting Financial Inclusion

While it’s not difficult to excuse CBDCs, they additionally empower some real applications that would improve the overall population’s lives.

Monetary consideration is maybe the main benefit of a CBDC-driven economy. Agricultural countries, including Kenya and India, have seen tremendous upticks in monetary incorporation at the command of installment administrations like M-Pesa.

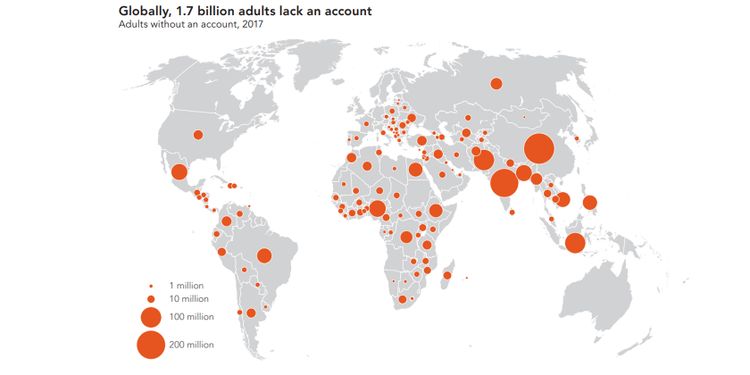

Government-sponsored advanced monetary forms would help accomplish comparable degrees of monetary assistance reception among the majority. In 2017, the World Bank assessed that around 1.7 billion people actually had zero openness to any type of current financial administrations.

Furthermore, CBDCs could make saving and contributing fundamentally more open to recently minimized areas of the populace.

These people generally depend on money and trade frameworks, the two of which are incongruent with monetary administrations like loaning and credit. Government assistance plans would likewise be far simpler to carry out through a brought together computerized cash program, as long as general society receives it.

CBDCs Could Make It Easier to Send Money Across Borders

On the far edge of the range, CBDCs can likewise immeasurably improve the existences of those dependent on cross-line exchanges. As indicated by the World Bank, worldwide settlements came to $689 billion out of 2018, and that figure has been developing at a consistent speed from that point forward.

Today, a commonplace worldwide wire move includes a few delegates, high charges, and possibly a few days-worth of deferrals. In contrast to homegrown exchanges, which can be settled close promptly, the worldwide installments industry actually depends on the lethargic and maturing SWIFT organization.

While the SWIFT organization empowers abroad banks to move assets among themselves, this is just conceivable in the event that they have an immediate relationship. On the off chance that they don’t have a business relationship, a third bank may need to step in as a middle person.

In any case, at each progression of this cycle, administrative due perseverance steps can postpone the last exchange settlement. This additionally implies that cross-line exchanges are incredibly costly because of the contribution of different outsiders.

Digital currencies have effectively demonstrated that worldwide exchanges can be finished inside the space of minutes, if not seconds. Moreover, even costly exchanges can be balanced on an occupied blockchain in light of the fact that it is consistently a level rate, not a rate sum.

This implies that a Bitcoin client starting an exchange worth $25 million pays a similar expense as somebody moving $2,500. In the mean time, customary methods for worldwide settlement charge clients however much 5% of the exchange sum.

National Bank Digital Currencies Will Coexist With Cryptocurrencies

The advantages of computerized monetary forms in cross-line exchanges are clear to the point that even private players have endeavored to enter the environment.

In June 2019, Facebook declared Libra, a stablecoin planned explicitly in view of arising economies and worldwide installments (the venture is presently known as Diem). The organization even featured the symbolic’s potential for monetary consideration at a certain point.

Concerning national bank-gave advanced monetary standards, the future remaining parts splendid for their presentation and surprisingly ensuing reception by the majority. Decentralized and customary cryptographic forms of money, then, aren’t disappearing at any point in the near future all things considered. Almost certainly, both will coincide, with people inclining toward one over the other relying upon the utilization case.